PEJOURNAL – Although the Nord Stream 2 Russia-to-Germany pipeline is 94 percent complete but Washington wants to keep it that way.

A hulking Russian pipe-laying vessel called the Akademik Cherskiy can be seen off Germany’s Baltic coast these days,marine tracking sites say, apparentlywaiting for the chance to complete the final stretches of a massive undersea pipeline that will carry natural gas directly to Germany from Russia.

The Trump administration, though, is trying to keep the pipeline, known as Nord Stream 2, on ice. Last week, the State Department moved to potentially impose economic penalties on investors and other business participants in the project, an expansion of existing sanctions.

The new measures were “a clear warning to companies” that “aiding and abetting Russia’s malign influence projects will not be tolerated,” Secretary of State Mike Pompeo told reporters. “Get out now, or risk the consequences.”

The threat from Washington has brought quick condemnation from European leaders, who called it interference in their sovereign right to set energy policy, but it may also put pressure on some European energy companies, including Royal Dutch Shell, that are backing the pipeline.

The project is described as 94 percent complete, and while backers are confident it will be finished, the sanctions threat has made it unclear when that will happen.

The pipeline, being built by a company owned by Gazprom, the Russian gas giant, has become the particular focus of concerns in Washington that Russia’s dominance of energy supplies to Europe could translate into political leverage for Moscow. Such worries are not new, as natural gas from the Soviet Union and, after its demise, Russia has been crucial to powering the European economy for decades.

Recently, though, President Vladimir V. Putin’s aggressive approach to Russia’s foreign policy has heightened worries about his ambitions. And now that the United States has ample supplies of gas from shale drilling and fracking, there is widespread suspicion that Washington may be using geopolitical concerns to bolster American exports of liquefied natural gas.

“We want them to buy from us, not the Russians,” said Robert McNally, president of Rapidan Energy Group, a market research firm, describing Washington’s policy.

Senator Ted Cruz, Republican of Texas, which is a key exporter of fuels, is helping sponsor even tougher sanctions legislation and has called the pipeline “a critical threat to America’s national security.”

Some analysts say the United States could now use sanctions to target five European companies that are providing financial backing for up to half the cost of the 9.5 billion euro ($11 billion) Nord Stream 2. Besides Shell, Europe’s largest oil company, they are Uniper, a German utility; OMV, the Austrian energy company; Engie, a French energy firm; and Wintershall Dea, a German oil company. On the other hand, with the project largely complete and major financial commitments already made, some say these companies may not have much to worry about.

Still, European officials and business leaders are bristling at what they say is Washington’s interference in European matters.

“The U.S. administration is disrespecting Europe’s right and sovereignty to decide itself where and how we source our energy,” said Heiko Maas, Germany’s foreign minister.

The European Union’s foreign policy chief, Josep Borrell, said he was “deeply concerned at the growing use of sanctions, or the threat of sanctions, by the United States against European companies and interests.”

German business representatives also say the dispute threatens to further sour trans-Atlantic economic ties that have already been strained during the Trump administration.

“It will be a very dangerous precedent that a third country can impose its rules on European sovereignty and rule of law,” said Michael Harms, managing director of the German Eastern Business Association, an industry group that promotes trade with Russia.

Mr. Harms warned that German businesses were talking of retaliating by seeking a ban on imported gas derived from fracking — a procedure responsible for most of the gas exported from the United States but banned in Germany.

While countries like Germany and France tend to shrug off fears of being too dependent on Russian energy, other countries, like Poland and Lithuania, have built their own liquefied natural gas facilities to ensure energy independence from Russia. Germany, Europe’s largest economy, is also studying building such facilities, although analysts say neighboring countries have plenty of capacity that Germany can use.

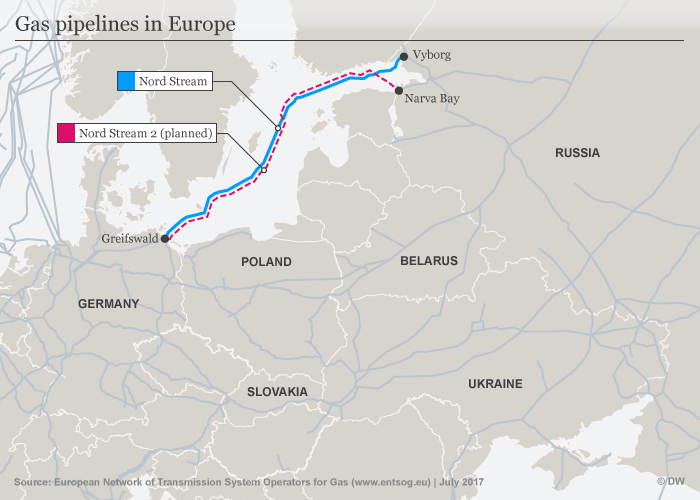

Construction of Nord Stream 2, which will roughly double the amount of gas that Russia can supply directly to Germany by pipeline, was moving along rapidly until December when the threat of U.S. sanctions against contractors led Allseas, a Swiss-Dutch company, to withdraw its advanced pipe-laying ships, leaving the 760-mile line about 50 miles short. Germany is already receiving Russian gas through an existing pipeline that was completed in 2012.

“We are forced to look for new solutions to lay the remaining 6 percent of our pipeline,” a Nord Stream spokesman wrote in an email Thursday. “We are looking for options and will inform about our plans in due time.”

Gazprom, analysts say, has been working on a plan to complete the remaining work, which is mostly in Danish waters, with its own vessels. The project seemed to have clear sailing when a Danish agency said on July 6 that it would allow the company to proceed with other vessels.

Mr. Pompeo continued to press the case this week on a trip to Europe that included a stopover in Denmark, but he apparently did not find a receptive audience. During a news conference with Mr. Pompeo in Copenhagen on Wednesday, the Danish foreign minister, Jeppe Kofod, appeared to rule out blocking the pipeline.

“The pipeline runs through Denmark’s economic zone, and here international rules apply and we abide by those,” Mr. Kofod said, according to Bloomberg News.

Washington could still cause more delays and raise the costs for Gazprom, but most analysts expect the pipeline to be completed because it is so close to the finish line and because Gazprom needs it to bring gas from new fields it is developing to market. The pipeline would also, theoretically, allow Gazprom’s gas to largely avoid going through Ukraine, a longstanding aim, although the Russian company agreed at the end of last year to continue shipping substantial amounts of the fuel through Ukraine for five more years.

“They are not going to abandon the project, because they have put so much into it,” said Jane Rangel, an analyst at Energy Aspects, a research firm.

At the moment, the European gas market that the United States and Russia are competing for is not all that enticing. Prices have fallen about 75 percent over the last two years, as a surge of new supplies from the United States and elsewhere swamped the market. More recently, demand has fallen as lockdowns designed to tackle the pandemic have cut energy needs. Growing pressures to reduce carbon emissions are also raising questions about future demand for gas.

Thane Gustafson, the author of a new book on European gas links to Russia, “The Bridge: Natural Gas in a Redivided Europe,” said that while Washington worried about Gazprom in Europe, the Russian company was actually beginning to turn its attention to faster-growing Asian markets.

“The Russians understand that the European market — within another decade or so — is going to start to stagnate and decline,” he said. “They are starting to shift their strategy to respond to that.”